Do I need to pay VAT?

Sonetel charges VAT (Value added taxes) as follows.

- Companies outside Europe.

No VAT is charged. - Swedish companies.

Swedish VAT applies on payments and usage. - Other European companies.

If a valid European VAT number can be provided (see below), no VAT is charged.

If no valid European VAT registration number is provided, VAT is charged in accordance with the standard VAT percentage in your country (the country selected prior to making the first payment).

How to enter a European VAT number

If you want to avoid paying VAT and have a European VAT registration number – please follow these steps:

- Sign in

Sign in at sonetel.com. - Select “Company Settings”

Click on Settings cog in the bottom left corner of the screen.

Settings cog in the bottom left corner of the screen.

- Select Billing and VAT

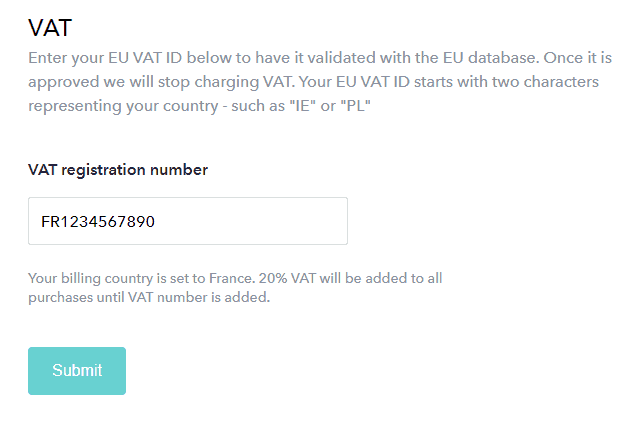

- Enter VAT ID

Enter your VAT ID with the initial 2 letters for your country, such as PL or FR. - Submit

We will immediately check your VAT ID towards the EU database.

Sonetel’s VAT number

Sonetel’s VAT registration number is;

SE556486584701

Certificate of residency

Sweden

Spain

Certificate of residence 2025 – for Spain

Certificate of residence 2024 – for Spain

Certificate of residence 2023 – for Spain

Certificate of residence 2022 – for Spain

Certificate of residence 2021 – for Spain

Certificate of residency 2019 – for Spain

Portugal

Certificate of residence 2025 – for Portugal

Certificate of residence 2021 – for Portugal

Certificate of residence 2019 – for Portugal

Romania

Certificate of residence 2025 – for Romania

Certificate of residence 2024 – for Romania

Certificate of residence 2023 – for Romania

Certificate of residence 2022 – for Romania

Certificate of residence 2021 – for Romania

Certificate of residence 2020 – for Romania

Poland

Certificate of residence 2025 – for Poland

Certificate of residence 2024 – for Poland

India

Certificate of residence 2025 – for India

Certificate of residence 2024 – for India